How to Save Money on Health Insurance Premiums: Practical Tips and Strategies.

Introduction

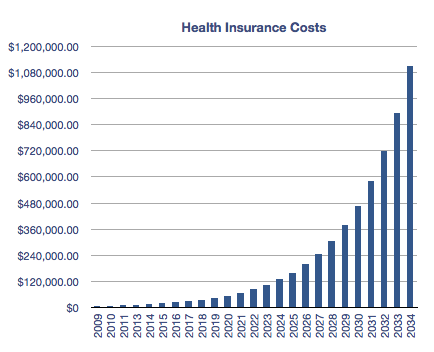

Health insurance is a necessary expense for individuals and families, but in recent years, premiums have increased substantially. According to the Kaiser Family Foundation, health insurance premiums for employer-sponsored plans have been rising consistently over the last decade. With healthcare costs rising year after year, it’s understandable that many people are searching for ways to reduce these costs without sacrificing the coverage they need.

The good news is that saving on your health insurance premiums is possible, and it doesn’t require drastic measures or reducing your level of coverage. By understanding how premiums are calculated, reviewing your current plan, and making certain lifestyle changes, you can significantly cut your premiums while still maintaining adequate protection.

In this in-depth guide, we’ll explore effective strategies that can help lower your premiums. We will dive into everything from understanding the components of health insurance premiums, to how to compare and choose the best plan for your needs, and even how your lifestyle habits can influence the cost of coverage. Whether you’re looking for a long-term strategy or a quick fix, this guide will help you achieve the goal of paying less for health insurance while getting the coverage you need.

Understanding Health Insurance Premiums

Before diving into strategies for saving money, it’s essential to have a solid understanding of what health insurance premiums are, how they are calculated, and the factors that contribute to their increase. With this knowledge, you can make informed decisions about how to manage and reduce your premium costs.

What Are Health Insurance Premiums?

At its core, a health insurance premium is the amount you pay monthly to your insurance provider in exchange for health coverage. This premium allows you to access a network of healthcare providers and medical services when you need them, often in the form of coverage for doctor visits, hospital stays, preventive services, prescriptions, and sometimes even dental and vision care.

However, premiums are only one aspect of the costs associated with health insurance. In addition to your monthly premium, most health insurance plans involve other costs, such as:

Deductibles: The amount you must pay out-of-pocket before your insurance starts to contribute to your medical expenses.

Copayments: Fixed fees you pay when you visit a doctor or receive a service.

Coinsurance: The percentage of costs you share with your insurance after meeting your deductible.

While premiums are the most visible cost, these additional costs can add up and significantly impact your overall healthcare expenses.

Factors That Affect Your Premiums

Several factors influence how much you pay for your health insurance premium. Some of these are within your control, while others, such as your age and health status, are not. Here are the key factors that affect your premiums:

Age: Older individuals generally face higher premiums. As you age, the likelihood of requiring more medical care increases, leading insurers to charge more for coverage.

Location: Health insurance premiums vary based on your location because of the regional differences in healthcare costs, provider availability, and insurance competition. Some states and regions have higher premiums than others.

Tobacco Use: Smokers typically face higher premiums due to the increased risk of tobacco-related diseases like lung cancer, heart disease, and respiratory issues. In some states, tobacco users can pay up to 50% more than non-smokers.

Health Status: Those with chronic conditions such as diabetes, hypertension, or asthma may face higher premiums. While insurers can no longer deny coverage based on pre-existing conditions due to the Affordable Care Act, they can still charge higher rates for those with medical conditions.

Family Size: Premiums for family plans are higher than for individual plans, as they cover multiple individuals with different healthcare needs. Each family member’s age and health status will influence the overall cost.

Plan Type: The type of health insurance plan you choose also plays a role in the cost. For example, PPO (Preferred Provider Organizations) plans typically have higher premiums because they offer more flexibility in choosing healthcare providers. HMO (Health Maintenance Organizations) plans, on the other hand, generally have lower premiums but limit your provider choices.

By understanding how these factors influence your premiums, you can better navigate the process of selecting a plan that suits your financial situation and healthcare needs.

How Premiums Are Calculated

Health insurance premiums are calculated based on a combination of the factors mentioned above. Insurers evaluate your age, health status, location, and lifestyle habits to assess your overall risk. Essentially, the more likely you are to need medical services, the higher your premium will be.

The insurer uses a risk pool of policyholders to determine the cost of coverage. If you live in an area with higher healthcare costs or a higher concentration of people with chronic conditions, your premiums may be higher because the insurer anticipates needing to pay out more in claims. Conversely, in regions with lower healthcare costs or healthier populations, premiums may be lower.

Premiums are also influenced by the specific health plan you choose. Plans that offer more extensive coverage or additional benefits tend to have higher premiums. However, this doesn’t mean you should automatically opt for the cheapest plan available—if you need more comprehensive coverage, a slightly higher premium could be worth the extra cost.

How to Lower Your Health Insurance Cost In 2025

Assessing Your Health Insurance Needs

One of the best ways to reduce your health insurance premiums is to ensure you’re not paying for unnecessary coverage. By taking the time to assess your health needs and lifestyle, you can select a plan that provides the right level of coverage without overpaying.

Choosing the Right Plan for You

When choosing a health insurance plan, it’s essential to consider your current health status and potential future healthcare needs. Here are some steps to help you choose the right plan:

- Assess Your Health Status: Are you generally healthy with no chronic conditions? Do you have frequent medical needs due to a pre-existing condition or ongoing treatments? Your health history plays a key role in determining what type of plan is best for you.

- Evaluate Your Family’s Health Needs: If you’re choosing a plan for your family, consider the health needs of each member. Does anyone have a chronic condition? Are you planning to have a baby in the near future? Knowing what services you may need will help you choose a plan that covers the right treatments.

- Estimate Your Future Healthcare Needs: If you anticipate needing more care in the future, such as planned surgeries or maternity care, you might want a plan with more comprehensive coverage. However, if you’re generally healthy and only need occasional care, a more basic plan could be sufficient.

How to Analyze Your Health Needs

Taking a closer look at your healthcare needs will help you make an informed decision about which plan will save you the most money. Here are some questions to ask yourself:

Do you have a chronic condition that requires ongoing treatment, medication, or specialist visits? If so, you may need a more comprehensive plan with higher coverage for these services.

Do you need prescription medications? Prescription drug coverage can vary widely between plans, so it’s crucial to choose one that offers the medications you take at a reasonable cost.

Are you planning any major life events that may affect your healthcare needs, such as pregnancy or surgery? Ensure your plan covers these events adequately.

How often do you visit doctors? If you rarely need medical care, you may be able to save money by opting for a plan with a higher deductible and lower premiums.

Importance of Matching Coverage to Your Lifestyle

Your lifestyle and habits should play a significant role in choosing your health insurance plan. If you live an active lifestyle or have a job that involves physical labor, you might want to choose a plan that provides comprehensive coverage for injuries and physical therapy. On the other hand, if you work in a sedentary office job and have a generally healthy lifestyle, a high-deductible plan might be a good fit.

Matching your coverage to your lifestyle ensures you’re not overpaying for benefits you don’t need, and it ensures that you’re fully covered for any medical events specific to your situation.

Strategies to Lower Your Health Insurance Premiums

Once you’ve evaluated your health needs, the next step is to implement strategies to lower your premiums. Here are several effective ways to reduce the cost of your health insurance premiums.

Compare Different Health Insurance Plans

One of the most straightforward ways to save money is by shopping around and comparing different health insurance plans. Many people renew their plans without comparing options, which can lead to higher premiums than necessary. Use online comparison tools to compare the premiums, deductibles, and out-of-pocket costs of different plans. Be sure to also check what’s included in the coverage and if the plan offers access to the healthcare providers you prefer.

Increase Your Deductible

A higher deductible can result in lower premiums. The deductible is the amount you have to pay out-of-pocket for healthcare services before your insurance begins to cover the costs. By choosing a plan with a higher deductible, your monthly premiums will be lower. However, keep in mind that if you need medical care, you’ll have to pay more out-of-pocket before your insurance kicks in. This strategy is best for individuals who are generally healthy and don’t anticipate frequent medical visits.

Consider a Health Savings Account (HSA)

Health Savings Accounts (HSAs) are tax-advantaged accounts that allow you to set aside money for healthcare costs. HSAs are available only if you have a high-deductible health plan (HDHP). You can contribute pre-tax dollars to your HSA, and the funds can be used for qualified medical expenses. The money you contribute to an HSA rolls over from year to year, allowing you to build savings for future healthcare costs.

Look for Discounts and Subsidies

Many employers offer health insurance plans with discounted premiums. If your employer offers a group plan, take advantage of the opportunity to get coverage at a reduced rate. Additionally, if your household income falls below a certain threshold, you may qualify for government subsidies through the Affordable Care Act. These subsidies can significantly reduce your monthly premiums, making healthcare more affordable.

Maintain a Healthy Lifestyle

Your lifestyle can have a direct impact on your health insurance premiums. Insurers reward healthy individuals with lower premiums because they are considered lower-risk. Here’s how maintaining a healthy lifestyle can help:

Exercise regularly: Staying active can lower your risk of chronic diseases and reduce the amount of medical care you need.

Eat a balanced diet: A healthy diet can prevent conditions like obesity and high blood pressure, which can raise premiums.

Quit smoking: Smoking is one of the leading causes of higher health insurance premiums, so quitting can result in significant savings.

Exploring Alternative Insurance Options

If you’re still struggling with high premiums, there are a few alternative insurance options worth considering. While they may not be suitable for everyone, they can provide temporary or more affordable coverage.

Short-Term Health Plans

Short-term health plans are designed to offer temporary coverage, often for individuals who are between jobs or waiting for other coverage to begin. These plans tend to have lower premiums but limited coverage, typically excluding essential services like maternity care, mental health, and pre-existing conditions. If you need short-term coverage and don’t require comprehensive benefits, these plans can offer a lower-cost solution.

High-Deductible Health Plans (HDHPs)

HDHPs have lower premiums but higher deductibles. These plans are ideal for individuals who are generally healthy and don’t expect to require much medical care. If you combine an HDHP with an HSA, you can save on premiums and accumulate savings for future healthcare costs.

Maximizing Your Health Insurance Benefits

To make the most of your health insurance plan, it’s important to use all the benefits available to you. Here are some ways to maximize your plan’s value:

Take Advantage of Preventative Care

Many health insurance plans offer free or low-cost preventive services like vaccinations, screenings, and wellness check-ups. By using these services, you can catch potential health problems early, which can help you avoid expensive treatments later. Make sure to schedule routine screenings like mammograms, colonoscopies, and cholesterol checks.

Use In-Network Providers

Staying in-network is one of the best ways to minimize healthcare costs. In-network providers have agreements with your insurer to provide services at lower rates. If you choose out-of-network providers, you may be required to pay a larger portion of the bill, which can drive up your overall healthcare expenses.

Common Mistakes That Increase Premiums

While it’s important to focus on ways to save money, it’s just as crucial to avoid making mistakes that can increase your premiums unnecessarily. Here are some common errors to watch out for:

Overlooking Preventative Care

Many people skip preventative care services, such as annual check-ups and screenings, which can lead to more severe health problems in the future. Preventive care is typically covered at no extra cost, so take full advantage of it to keep your health in check and avoid more expensive treatments later.

Choosing the Wrong Plan for Your Needs

Choosing a plan with too much coverage can result in paying higher premiums than necessary. On the flip side, selecting a plan with too little coverage can leave you vulnerable to high out-of-pocket costs. Always match your plan to your health needs to avoid overpaying.

Not Comparing Plans Regularly

Health insurance plans can change annually, and your healthcare needs may change as well. Be sure to review and compare plans during open enrollment to ensure you’re getting the best deal and coverage.

Conclusion

Reducing health insurance premiums doesn’t have to be complicated. By taking a proactive approach and understanding your options, you can significantly lower your premiums while maintaining comprehensive coverage. Whether you choose to shop around for a better plan, increase your deductible, or make healthy lifestyle changes, the right strategies can save you money and improve your overall financial well-being.

By staying informed, comparing plans, and using all the available benefits, you’ll be able to protect your health and your wallet. Don’t forget to review your health insurance coverage regularly to ensure you’re always getting the best deal.

Frequently Asked Questions (FAQs)

What is the best way to lower my health insurance premiums?

The best way to lower your premiums is to shop around and compare plans, increase your deductible, and utilize Health Savings Accounts (HSAs). Additionally, maintaining a healthy lifestyle can help reduce premiums.

Can I save money on health insurance if I have pre-existing conditions?

Yes, you may qualify for government subsidies or specialized plans if you have pre-existing conditions, which can help reduce premiums.

Is it worth paying a higher deductible to lower premiums?

If you’re generally healthy and don’t anticipate needing frequent care, paying a higher deductible can significantly lower your premiums.

How often should I compare health insurance plans?

You should compare plans annually, especially during open enrollment periods, to ensure you’re getting the best deal and coverage.

Are there any government programs that help with health insurance premiums?

Yes, programs like Medicaid and subsidies through the Affordable Care Act (ACA) can help reduce premiums for qualifying individuals and families.

Leave a Reply