TABLE OF CONTENTS

1. Introduction

- Brief overview of the importance of health insurance for individuals with mental challenges.

- Why it’s crucial to choose the right plan.

- What Makes a Good Health Insurance Plan for Mental Challenged Citizens?

- Coverage for mental health conditions.

- Flexibility in treatment options.

- Affordable

- Why Mental Health Matters in Health Insurance Plans

- Growing awareness and support for mental health.

- Government regulations and requirements for mental health coverage.

- Benefits of comprehensive mental health care.

- Criteria for Choosing the Best Health Insurance Plan for Mental Challenged Citizens

- Network of mental health providers.

- Coverage for inpatient and outpatient services.

- Prescription medication coverage.

- Mental health specialists and therapy options.

- Coverage for additional services like counseling, rehabilitation, and support groups.

- Top 7 Health Insurance Plans for Mental Challenged Citizens in 2025

- UnitedHealthcare: The Best for Comprehensive Mental Health Coverage

- In-depth coverage for mental health care.

- Offers therapy, counseling, and inpatient care.

- Blue Cross Blue Shield: Affordable and Accessible Mental Health Coverage

- Offers affordable premiums.

- Strong network of mental health professionals.

- Cigna Health: Best for Access to Specialists and Therapies

- Wide range of coverage for specialists and mental health therapies.

- Excellent outpatient care options.

- Aetna Health Insurance: A Plan with Mental Health Support at Every Stage

- Emphasizes preventative care for mental health.

- Offers telemedicine and online therapy services.

- Kaiser Permanente: Best for Integrated Care Services

- Focuses on integrated care for both mental and physical health.

- Seamless access to both physical and mental health treatments.

- Humana: Best for Behavioral Health Support

- Offers extensive behavioral health support services.

- Covers a wide range of mental health conditions.

- Oscar Health: Best for Telehealth Options

- Features easy access to mental health support through telehealth.

- Affordable pricing and ease of use.

- How to Enroll in the Best Health Insurance Plan for Mental Health in 2025

- Step-by-step guide to enrollment.

- Factors to consider before signing up.

- Understanding the Costs of Health Insurance for Mental Challenged Citizens

- How premiums vary by plan.

- Out-of-pocket costs and co-pays.

- Factors that affect overall affordability.

- The Future of Mental Health Coverage in Health Insurance

- New trends and emerging policies in mental health coverage.

- What changes to expect in the next few years.

- Conclusion

- Recap of the best health insurance options.

- Final recommendations for mental challenged citizens in 2025.

- FAQs

- What should I look for in a health insurance plan for mental health coverage?

- Are there any specific plans that cover both physical and mental health issues?

- How can I make sure that my therapist is covered by my health insurance plan?

- What happens if my mental health care costs more than my plan covers?

- Is telehealth an effective option for mental health support?

7 Best Health Insurance Plans for Mental Challenged Citizens in 2025

Introduction

Health insurance is one of the most important safeguards for individuals facing mental health challenges. In 2025, it’s vital to choose a plan that not only covers physical health needs but also offers strong mental health coverage. Whether you or a loved one is navigating a mental health condition, understanding which health insurance plans provide the best coverage can make all the difference in receiving the care needed for a fulfilling life. Let’s dive into the best options for 2025 and what makes them stand out.

What Makes a Good Health Insurance Plan for Mental Challenged Citizens?

A comprehensive health insurance plan for individuals with mental challenges goes beyond just covering basic doctor visits. The right plan should:

- Provide adequate mental health coverage for both inpatient and outpatient services.

- Offer flexible treatment options, including therapy and counseling.

- Be affordable without skimping on necessary services like prescriptions and specialist visits.

With these criteria in mind, let’s explore why mental health should be a key consideration when selecting a health insurance plan.

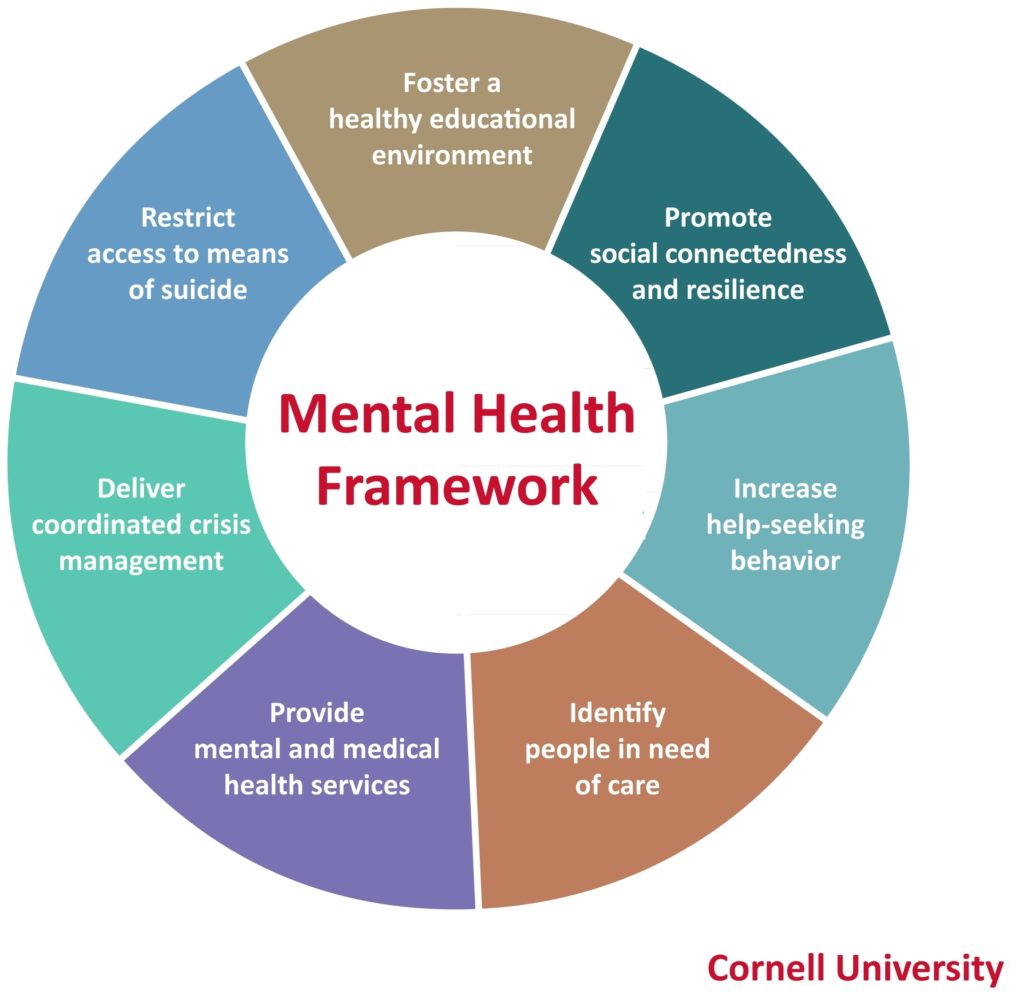

Why Mental Health Matters in Health Insurance Plans

Mental health has come a long way in terms of recognition and importance within the healthcare system. More than ever, health insurance plans are required to provide mental health coverage, thanks to regulations like the Affordable Care Act (ACA), which mandates coverage for mental health and substance use disorders. The goal is to provide individuals with the necessary resources to address their mental health needs in a supportive, accessible way.

Criteria for Choosing the Best Health Insurance Plan for Mental Challenged Citizens

When evaluating a health insurance plan for someone with mental health needs, consider the following:

- Network of mental health providers: Ensure the plan has a wide array of therapists, psychiatrists, and support groups.

- Coverage for inpatient and outpatient services: Look for coverage for both types of services.

- Prescription medication coverage: Mental health medications are essential, and your plan should cover them.

- Therapist options and support services: Coverage for therapies like CBT, group therapy, and behavioral interventions is crucial.

- Specialist care: Choose a plan that offers mental health specialists and other support services.

Top 7 Health Insurance Plans for Mental Challenged Citizens in 2025

UnitedHealthcare: The Best for Comprehensive Mental Health Coverage UnitedHealthcare offers some of the most comprehensive mental health services in the industry. The plan covers inpatient and outpatient care, including therapy, counseling, and access to specialists. Their vast network of mental health providers ensures that members have easy access to necessary services.

- Blue Cross Blue Shield: Affordable and Accessible Mental Health Coverage With competitive pricing, Blue Cross Blue Shield offers solid coverage for individuals facing mental health challenges. The network includes a diverse range of mental health professionals, making it easy to find the right help.

- Cigna Health: Best for Access to Specialists and Therapies Cigna excels at providing specialized care and a variety of therapy options. Their plans also cover mental health prescriptions, ensuring that individuals can get the help they need without financial strain.

- Aetna Health Insurance: A Plan with Mental Health Support at Every Stage Aetna’s approach to mental health is holistic, offering preventative care alongside inpatient and outpatient services. Aetna also offers telemedicine options for easier access to mental health services.

- Kaiser Permanente: Best for Integrated Care Services Kaiser Permanente stands out by integrating physical and mental health care. This plan ensures that individuals can address their mental health needs alongside their general health, promoting a holistic approach to well-being.

- Humana: Best for Behavioral Health Support Humana provides a variety of behavioral health services, including addiction recovery, therapy, and emotional support. Their plans focus on offering a wide range of services for mental and behavioral health.

- Oscar Health: Best for Telehealth Options Oscar Health provides a great option for individuals who prefer telehealth services for their mental health. Affordable pricing and easy access to online therapy make this plan a convenient choice for many.

How to Enroll in the Best Health Insurance Plan for Mental Health in 2025

Enrolling in the best health insurance plan is easy if you know what to look for. Here’s a step-by-step guide:

- Determine eligibility: Check if you qualify for government assistance programs or if your employer offers health insurance.

- Compare plans: Use online comparison tools or speak to an insurance broker to find the best plan for your needs.

- Enroll online or via phone: Most plans offer online enrollment, making it easy to apply.

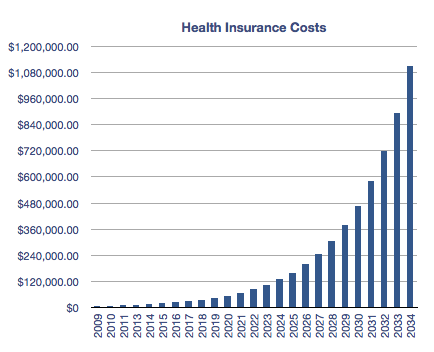

Understanding the Costs of Health Insurance for Mental Challenged Citizens

The cost of health insurance can vary significantly depending on the plan you choose. Factors include:

- Premiums: The amount you pay monthly for coverage.

- Out-of-pocket costs: This includes co-pays, deductibles, and coinsurance, which can add up.

- Coverage level: More comprehensive coverage usually means higher premiums.

The Future of Mental Health Coverage in Health Insurance

As awareness of mental health continues to grow, insurance companies are expected to offer even more comprehensive mental health coverage in the coming years. New technologies, such as telemedicine and mental health apps, will continue to evolve and become more integrated into health insurance plans.

How to Save Money on Health Insurance Premiums: Practical Tips and Strategies

Conclusion

Choosing the right health insurance plan for mental challenged citizens is essential for ensuring that they receive the best possible care. By considering factors like affordability, mental health coverage, and the availability of specialists, you can select a plan that provides comprehensive support. The plans listed above are great options to consider in 2025.

FAQs

- What should I look for in a health insurance plan for mental health coverage? Look for plans with robust networks of mental health providers, extensive coverage for therapies, and prescription medication options.

- Are there any specific plans that cover both physical and mental health issues? Yes, plans like Kaiser Permanente integrate both physical and mental health services, offering a holistic approach to care.

- How can I make sure that my therapist is covered by my health insurance plan? Verify the therapist’s credentials with your insurance provider to ensure they are part of the network.

- What happens if my mental health care costs more than my plan covers? If your costs exceed your coverage, you may need to pay the difference, or you can explore financial assistance options through your provider.

- Is telehealth an effective option for mental health support? Yes, telehealth services offer an accessible and effective way to receive therapy and mental health support from the comfort of your home.

For more information, you can refer to the

- Blue Cross Blue Shield: Affordable and Accessible Mental Health Coverage With competitive pricing, Blue Cross Blue Shield offers solid coverage for individuals facing mental health challenges. The network includes a diverse range of mental health professionals, making it easy to find the right help.

- Cigna Health: Best for Access to Specialists and Therapies Cigna excels at providing specialized care and a variety of therapy options. Their plans also cover mental health prescriptions, ensuring that individuals can get the help they need without financial strain.

- Aetna Health Insurance: A Plan with Mental Health Support at Every Stage Aetna’s approach to mental health is holistic, offering preventative care alongside inpatient and outpatient services. Aetna also offers telemedicine options for easier access to mental health services.

- Kaiser Permanente: Best for Integrated Care Services Kaiser Permanente stands out by integrating physical and mental health care. This plan ensures that individuals can address their mental health needs alongside their general health, promoting a holistic approach to well-being.

- Humana: Best for Behavioral Health Support Humana provides a variety of behavioral health services, including addiction recovery, therapy, and emotional support. Their plans focus on offering a wide range of services for mental and behavioral health.

- Oscar Health: Best for Telehealth Options Oscar Health provides a great option for individuals who prefer telehealth services for their mental health. Affordable pricing and easy access to online therapy make this plan a convenient choice for many.

How to Enroll in the Best Health Insurance Plan for Mental Health in 2025

Enrolling in the best health insurance plan is easy if you know what to look for. Here’s a step-by-step guide:

- Determine eligibility: Check if you qualify for government assistance programs or if your employer offers health insurance.

- Compare plans: Use online comparison tools or speak to an insurance broker to find the best plan for your needs.

- Enroll online or via phone: Most plans offer online enrollment, making it easy to apply.

Understanding the Costs of Health Insurance for Mental Challenged Citizens

The cost of health insurance can vary significantly depending on the plan you choose. Factors include:

Premiums: The amount you pay monthly for coverage.

Out-of-pocket costs: This includes co-pays, deductibles, and coinsurance, which can add up.

Coverage level: More comprehensive coverage usually means higher premiums.

The Future of Mental Health Coverage in Health Insurance

As awareness of mental health continues to grow, insurance companies are expected to offer even more comprehensive mental health coverage in the coming years. New technologies, such as telemedicine and mental health apps, will continue to evolve and become more integrated into health insurance plans.

Conclusion

Choosing the right health insurance plan for mental challenged citizens is essential for ensuring that they receive the best possible care. By considering factors like affordability, mental health coverage, and the availability of specialists, you can select a plan that provides comprehensive support. The plans listed above are great options to consider in 2025.

FAQs

- What should I look for in a health insurance plan for mental health coverage? Look for plans with robust networks of mental health providers, extensive coverage for therapies, and prescription medication options.

- Are there any specific plans that cover both physical and mental health issues? Yes, plans like Kaiser Permanente integrate both physical and mental health services, offering a holistic approach to care.

- How can I make sure that my therapist is covered by my health insurance plan? Verify the therapist’s credentials with your insurance provider to ensure they are part of the network.

- What happens if my mental health care costs more than my plan covers? If your costs exceed your coverage, you may need to pay the difference, or you can explore financial assistance options through your provider.

- Is telehealth an effective option for mental health support? Yes, telehealth services offer an accessible and effective way to receive therapy and mental health support from the comfort of your home.

For more information, you can refer to thehttp://National Alliance on mental illness.

for resources and guides.

Leave a Reply