TABLE OF CONTENTS

- Introduction to Marketplace Insurance

- What is Marketplace Insurance?

- The Importance of Marketplace Insurance in Today’s Health Landscape.

- Who is Eligible for Marketplace Insurance?

- How Marketplace Insurance Works

- The Affordable Care Act and Its Role in Marketplace Insurance

- Understanding the Enrollment Process

- Types of Marketplace Insurance Plans

- The Benefits of Marketplace Insurance

- Financial Assistance Options

- Comprehensive Coverage Benefits

- Access to a Wide Range of Healthcare Providers

- Marketplace Insurance vs. Employer-Sponsored Insurance

- Key Differences Between the Two

- How to Choose Between Marketplace Insurance and Employer Insurance

- Cost of Marketplace Insurance

- Monthly Premiums and Deductibles

- Out-of-Pocket Costs and Cost-sharing Reductions

- How to Save Money on Marketplace Insurance

- How to Apply for Marketplace Insurance

- Steps to Take for a Successful Application

- Documentation You’ll Need

- Common Mistakes to Avoid When Applying

- Marketplace Insurance During Special Enrollment Periods

- What is Special Enrollment?

- Who Qualifies for Special Enrollment?

- Important Deadlines and Timelines

- Challenges with Marketplace Insurance

- Coverage Gaps and Out-of-Network Issues

- The Complexity of Navigating Plans

- Common Misconceptions About Marketplace Insurance

- Changes to Marketplace Insurance in 2025

- Anticipated Changes in Premiums and Coverage

- How Healthcare Reform May Impact Marketplace Insurance

- Conclusion

- Is Marketplace Insurance Right for You?

- Key Takeaways

- FAQs

- What are the eligibility requirements for Marketplace Insurance?

- How can I reduce my Marketplace Insurance premiums?

- Can I switch Marketplace Insurance plans mid-year?

- What happens if I miss the Open Enrollment period?

- Does Marketplace Insurance cover dental and vision care?

Health Insurance Marketplace

Introduction to Marketplace Insurance

Marketplace insurance, also known as the Health Insurance Marketplace or Exchange, offers health plans designed to help individuals and families get coverage in a way that’s affordable and accessible. This form of insurance is available for people who don’t have health coverage through their employer or government programs like Medicaid or Medicare.

What is Marketplace Insurance?

The Health Insurance Marketplace, created under the Affordable Care Act (ACA), is an online platform where people can shop for and compare health insurance plans. Marketplace insurance allows you to choose a plan based on your specific health needs, budget, and personal preferences.

The Importance of Marketplace Insurance in Today’s Health Landscape

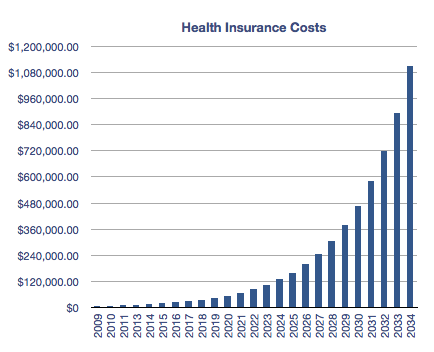

With healthcare costs rising, marketplace insurance provides an essential safety net for millions of Americans who may otherwise go without coverage. It plays a crucial role in reducing the number of uninsured people, ensuring that more individuals and families can access necessary health services.

Who is Eligible for Marketplace Insurance?

Generally, anyone who is a U.S. citizen or legal resident can apply for marketplace insurance. Eligibility is particularly relevant for individuals who do not have access to health coverage through an employer or a government program. Low-income individuals may also qualify for subsidies that reduce their monthly premiums.

How Marketplace Insurance Works

Marketplace insurance operates on the principles of affordability and accessibility. It offers several tiers of coverage and allows for comparison shopping so you can choose the best plan for your needs.

The Affordable Care Act and Its Role in Marketplace Insurance

The Affordable Care Act (ACA) revolutionized healthcare in the United States, mandating the creation of the Health Insurance Marketplace. The ACA made insurance coverage more affordable by providing subsidies and expanding Medicaid in some states. The goal was to provide everyone with the opportunity to secure health insurance regardless of their pre-existing conditions.

Understanding the Enrollment Process

The enrollment process involves creating an account on the Marketplace website, comparing available plans, and selecting one that suits your needs. You’ll then provide information about your income, household size, and other personal details to determine eligibility for subsidies.

Types of Marketplace Insurance Plans

The Marketplace offers four main types of plans: Bronze, Silver, Gold, and Platinum. These plans differ based on the level of coverage and the costs associated with them. Bronze plans have lower premiums but higher deductibles, while Platinum plans have higher premiums and lower deductibles.

The Benefits of Marketplace Insurance

There are several advantages to enrolling in a Marketplace insurance plan, which include financial assistance and comprehensive healthcare benefits.

Financial Assistance Options

One of the biggest benefits is the availability of subsidies for those who meet income qualifications. The ACA offers tax credits to help make premiums more affordable, which can significantly lower out-of-pocket costs.

Comprehensive Coverage Benefits

Marketplace insurance plans cover essential health benefits, including hospital care, prescription drugs, preventive services, and mental health support. This ensures that individuals and families have access to a wide range of medical services.

Access to a Wide Range of Healthcare Providers

With Marketplace insurance, you’ll have access to an extensive network of healthcare providers, ensuring you get the care you need no matter where you live.

Marketplace Insurance vs. Employer-Sponsored Insurance

When it comes to choosing between Marketplace insurance and employer-sponsored insurance, there are several factors to consider.

Key Differences Between the Two

Employer-sponsored insurance is often more affordable because your employer typically pays a portion of the premium. However, Marketplace insurance can be a better option for those who are self-employed, work for a company that doesn’t offer coverage, or need more flexibility.

How to Choose Between Marketplace Insurance and Employer Insurance

When deciding between the two, consider factors like the cost of premiums, the coverage provided, and the networks of healthcare providers. If your employer offers affordable insurance with good coverage, that may be the best option. However, Marketplace insurance may be better if your employer’s plan is too expensive or doesn’t meet your needs.

Cost of Marketplace Insurance

Monthly Premiums and Deductibles

Marketplace insurance premiums vary based on the type of plan, your age, location, and income. Deductibles also differ, so it’s essential to choose a plan that balances affordable premiums with reasonable out-of-pocket costs.

Out-of-Pocket Costs and Cost-sharing Reductions

In addition to premiums, Marketplace insurance plans may have out-of-pocket costs, such as co-pays and deductibles. Fortunately, the ACA provides cost-sharing reductions for those who qualify, making healthcare even more affordable.

How to Save Money on Marketplace Insurance

To reduce the cost of Marketplace insurance, you can opt for a plan with a higher deductible or consider changing your coverage if your income fluctuates. Additionally, be sure to take advantage of subsidies and tax credits available to lower-income individuals.

How to Apply for Marketplace Insurance

Steps to Take for a Successful Application

Applying for Marketplace insurance is simple but requires some attention to detail. Start by visiting the Marketplace website, creating an account, and entering your personal information. After reviewing available plans, choose the one that fits your needs and budget.

Documentation You’ll Need

Be prepared to provide documents such as proof of income, household size, and citizenship status to complete your application. Having these documents ready will make the process faster and easier.

Common Mistakes to Avoid When Applying

Ensure that all your information is accurate, as mistakes can delay your application or affect your eligibility for subsidies. Don’t forget to check your income eligibility to avoid paying higher premiums than necessary.

Marketplace Insurance During Special Enrollment Periods

What is Special Enrollment?

Special enrollment periods (SEPs) are times when you can apply for Marketplace insurance outside of the regular open enrollment period. SEPs are triggered by significant life events such as marriage, the birth of a child, or losing other health coverage.

Who Qualifies for Special Enrollment?

If you experience a qualifying life event, you may qualify for a special enrollment period. Be sure to apply as soon as possible after the event to avoid a gap in coverage.

Important Deadlines and Timelines

Special enrollment periods typically last for 60 days, so it’s crucial to act quickly to ensure continuous coverage.

Challenges with Marketplace Insurance

While Marketplace insurance is a vital resource, there are some challenges to be aware of.

Coverage Gaps and Out-of-Network Issues

One potential drawback of Marketplace insurance is that some plans may not cover all healthcare services or providers, particularly if you have a plan with limited networks.

The Complexity of Navigating Plans

The sheer number of available plans and options can make it challenging to navigate the marketplace effectively. Take your time to compare the details and make an informed choice.

Common Misconceptions About Marketplace Insurance

Many people mistakenly believe that Marketplace insurance plans are too expensive or too complicated to navigate. In reality, the marketplace offers a variety of affordable plans that can meet your needs.

Changes to Marketplace Insurance in 2025

Anticipated Changes in Premiums and Coverage

In 2025, experts expect changes to premium prices and the level of coverage offered. Keep an eye on updates from the Health Insurance Marketplace to stay informed about any changes that may affect your plan.

How Healthcare Reform May Impact Marketplace Insurance

Healthcare reforms could lead to expanded coverage options and subsidies for those who qualify, making Marketplace insurance even more accessible.

Conclusion

Is Marketplace insurance the right choice for you? It offers comprehensive coverage, financial assistance, and flexibility, making it an excellent option for many. However, it’s essential to weigh the pros and cons, particularly in comparison to other options like employer-sponsored insurance.

FAQs

What are the eligibility requirements for Marketplace Insurance?

To qualify for Marketplace insurance, you need to be a U.S. citizen or legal resident who doesn’t have access to other forms of health insurance, like through your employer or Medicaid.

How can I reduce my Marketplace Insurance premiums?

You can reduce premiums by opting for a higher-deductible plan, shopping during open enrollment to compare different plans, and ensuring you’re receiving subsidies and tax credits.

Can I switch Marketplace Insurance plans mid-year?

You can switch plans only during special enrollment periods or during open enrollment. If you experience a life-changing event, you may qualify for a special enrollment period.

What happens if I miss the Open Enrollment period?

If you miss the open enrollment period, you may not be able to get Marketplace insurance unless you qualify for a special enrollment period due to a life event.

Does Marketplace Insurance cover dental and vision care?

Marketplace insurance plans typically do not include dental and vision care. However, you can purchase separate dental and vision plans through the Marketplace.

Leave a Reply