- Introduction

- Brief overview of health insurance for older citizens

- Importance of choosing the right plan

- Why Health Insurance is Crucial for Older Citizens

- Rising healthcare costs with age

- Increased medical needs as you age

- Factors to Consider When Choosing Health Insurance for Older Citizens

- Coverage options

- Premiums and affordability

- Network of healthcare providers

- Additional services like vision, dental, and hearing coverage

- Top 5 Health Insurance Plans for Older Citizens

- Aetna Medicare Advantage Plans

- Overview

- Benefits

- Pros and Cons

- Blue Cross Blue Shield Medicare Advantage

- Overview

- Benefits

- Pros and Cons

- Humana Medicare Advantage

- Overview

- Benefits

- Pros and Cons

- UnitedHealthcare AARP Medicare Supplement Plans

- Overview

- Benefits

- Pros and Cons

- Cigna Medicare Advantage

- Overview

- Benefits

- Pros and Cons

- How to Compare Different Health Insurance Plans for Older Citizens

- Things to look for when comparing

- Using online tools and resources to compare

- Common Misconceptions About Health Insurance for Older Citizens

- Debunking myths about premiums and coverage

- Clarifying eligibility criteria

- How to Enroll in Health Insurance Plans for Older Citizens

- Step-by-step process

- Enrollment periods and deadlines

- Conclusion

- Recap of the top health insurance plans

- Final tips on making an informed decision

- FAQs

- What are the main types of health insurance plans for seniors?

- How can I lower my health insurance premiums?

- What is the difference between a Medicare Advantage plan and a Medicare Supplement plan?

- Are health insurance plans for seniors more expensive than for younger people?

- Can I switch my health insurance plan after enrollment?

Top 5 Health Insurance Plans for Older Citizens You Need to Consider

Introduction

As we age, our healthcare needs increase. This makes it essential to find the right health insurance plan to protect your health and finances. Older citizens often face rising medical costs, and selecting a comprehensive insurance plan can help alleviate some of those expenses. In this post, we’ll explore the top 5 health insurance plans for older citizens, highlighting their benefits, drawbacks, and what you need to know before making a decision.

Why Health Insurance is Crucial for Older Citizens

Health insurance for older citizens is a must-have, as aging comes with a higher likelihood of chronic conditions, medical emergencies, and the need for ongoing healthcare services. The cost of healthcare is rising, and without proper coverage, older adults might find themselves burdened by steep medical bills. Here’s why health insurance is so important:

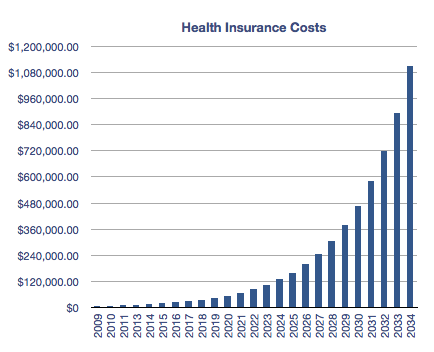

Rising Healthcare Costs: Older adults tend to have more frequent medical visits, prescriptions, and procedures, all of which add up.

Chronic Health Conditions: With age, managing conditions like diabetes, arthritis, and heart disease becomes crucial. Health insurance ensures that these conditions are treated without breaking the bank.

Factors to Consider When Choosing Health Insurance for Older Citizens

When choosing the right health insurance plan, there are several factors you need to consider. These include:

Coverage Options: Does the plan cover the essentials like hospitalization, surgery, and doctor’s visits? Does it also cover vision, hearing, and dental care?

Premiums and Affordability: Make sure the premiums are within your budget, but also check what’s included in the coverage.

Healthcare Provider Network: Ensure that your preferred doctors, hospitals, and specialists are included in the network.

Extra Benefits: Some plans offer additional benefits like wellness programs, fitness memberships, and discounts on health services.

Top 5 Health Insurance Plans for Older Citizens

Now, let’s take a look at five health insurance options that cater specifically to older citizens, focusing on their unique needs.

- Aetna Medicare Advantage Plans

Aetna offers a range of Medicare Advantage plans designed for seniors. These plans combine the benefits of Original Medicare (Parts A and B) and often include prescription drug coverage (Part D).

Benefits: Includes wellness programs, hearing, vision, and dental coverage, along with comprehensive care for chronic conditions.

Pros: Low out-of-pocket costs and additional benefits like gym memberships.

Cons: Limited network of providers in some regions.

- Blue Cross Blue Shield Medicare Advantage

https://www.southcarolinablues.com/

Blue Cross Blue Shield is a trusted name in healthcare, and its Medicare Advantage plans are no exception. They offer comprehensive coverage with low premiums and an extensive network.

- Benefits: Prescription drug coverage, preventive care, and dental, vision, and hearing services.

- Pros: Wide availability and access to a large network of doctors and specialists.

- Cons: Premiums may be higher in some states.

- Humana Medicare Advantage

Humana’s Medicare Advantage plans are well-regarded for their customer service and comprehensive coverage, making them an excellent choice for seniors.

- Benefits: Offers dental, vision, and hearing coverage, along with prescription drug plans.

- Pros: Extra perks like discounts on health-related products and services.

- Cons: Limited coverage in some rural areas.

4. UnitedHealthcare AARP Medicare Supplement Plans

https://www.aarp.org/membership/benefits/insurance/uhc-medicare-supplement/

UnitedHealthcare, in partnership with AARP, offers a wide range of Medicare Supplement plans. These plans help fill the gaps left by Original Medicare.

- Benefits: Provides extensive coverage for out-of-pocket costs like deductibles and coinsurance.

- Pros: Easy access to nationwide providers, plus a variety of plan options.

- Cons: Higher premiums for some plans.

- Cigna Medicare Advantage

https://www.cigna.com/

Cigna’s Medicare Advantage plans offer solid coverage options and competitive premiums, making them a great choice for older citizens looking for comprehensive care.

- Benefits: Prescription drug coverage, vision, dental, and hearing services.

- Pros: Affordable premiums and solid customer support.

- Cons: Limited availability in some areas.

How to Compare Different Health Insurance Plans for Older Citizens

When it comes to comparing different health insurance plans, there are a few things to keep in mind:

- Premiums and Out-of-Pocket Costs: Compare the monthly premiums and deductibles to ensure they fit your budget.

- Coverage: Look at what each plan covers, including hospital stays, doctor visits, prescriptions, and additional services like dental and vision care.

- Provider Networks: Make sure the plan includes the doctors, hospitals, and specialists you need.

- Additional Benefits: Some plans offer extra perks like wellness programs or fitness memberships, which can be valuable.

Common Misconceptions About Health Insurance for Older Citizens

Many older adults have misconceptions about health insurance, which can prevent them from making the best decision. Some of the common myths include:

- Myth 1: Medicare covers all healthcare costs – It’s important to remember that Medicare doesn’t cover everything. Some plans, like Medicare Supplement plans, help fill the gaps.

- Myth 2: Health insurance for seniors is too expensive – While some plans can be costly, there are many affordable options that provide comprehensive coverage.

How to Enroll in Health Insurance Plans for Older Citizens

Enrolling in a health insurance plan for older citizens is easy but requires attention to detail. Here’s what you need to know:

- Step 1: Determine the type of plan you need (Medicare Advantage, Medicare Supplement, etc.).

- Step 2: Review available plans in your area and compare coverage, costs, and benefits.

- Step 3: Apply during the appropriate enrollment period (e.g., the Medicare Annual Enrollment Period).

- Step 4: Provide any necessary documentation and choose your plan.

How to Save Money on Health Insurance Premiums: Practical Tips and Stra

tegies

Conclusion

Choosing the right health insurance plan is crucial for older citizens to ensure they have access to the care they need. From comprehensive coverage to affordable premiums, there are many great options available. Be sure to compare the top plans, considering your health needs, budget, and provider preferences. Health insurance doesn’t have to be overwhelming—start early, do your research, and make the best choice for your future health and well-being.

FAQs

- What are the main types of health insurance plans for seniors?

The main types are Medicare Advantage plans, Medicare Supplement plans, and Prescription Drug Plans (Part D).

- How can I lower my health insurance premiums?

Shop around for plans with lower premiums, consider high-deductible plans, and explore government assistance programs like Medicaid.

- What is the difference between a Medicare Advantage plan and a Medicare Supplement plan?

Medicare Advantage plans are an all-in-one alternative to Original Medicare, while Medicare Supplement plans help pay for costs not covered by Original Medicare.

- Are health insurance plans for seniors more expensive than for younger people?

Generally, premiums increase with age, but there are still affordable plans available, especially with government assistance.

- Can I switch my health insurance plan after enrollment?

Yes, you can switch plans during certain enrollment periods, such as the Medicare Open Enrollment Period.

Leave a Reply